How AR and VR Will Transform Financial Services and Technologies

Summarize with AI:

There are certain industries that seem perfect for augmented and virtual realities—like gaming and ecommerce. But what about financial services? In this post, we’ll look at four AR or VR use cases that are likely to appear within the next few years.

The financial services industry has undergone major disruption this past decade thanks to fintech. So is it ready to handle a new set of disruptions in the form of augmented and virtual reality?

Probably not in 2024 or 2025. However, just as fintech was a much-needed disruption that consumers warmly embraced, I suspect that AR and VR will be in a similar position within a few years.

If you’re developing digital products and experiences for FinServ or fintech, this is something to start thinking about now. While AR and VR can be expensive and difficult to implement, it’s only a matter of time before their usage in other industries like ecommerce and real estate makes its way over to the financial space.

In this post, we’ll look at four realistic use cases for AR and VR in financial product and experience development.

What Does the Future of AR and VR Look Like in Fintech?

It was around 10 years ago when people started talking about augmented and virtual realities in the financial services industries. Many of the major banks got in on the discussion, going so far as to mock up or prototype what these AR and VR environments would look like.

For example, this was what Citi had envisioned for its HoloLens holographic workstation for traders:

It’s been eight years since this concept was announced, and virtual trading still hasn’t caught on. At the time, developers typically had three reasons for not adopting AR and VR tech:

- There was no business requirement for it.

- There was no value in it.

- The Microsoft HoloLens was too pricey of a device.

While VR technology has gotten much cheaper in the years since, the first two reasons still ring true. At least for now.

The thing is, all it takes is just one major financial company to introduce a VR or AR feature that transforms the way consumers use their app to shake up the entire industry. So it’s a good idea to be prepared for these inevitable transformations in the industry.

While there are lots of ideas thrown around about what AR and VR are good for with regards to financial services, these are the four applications I think we’ll see sooner rather than later:

AR for Account Info

With how touchless our payment systems are becoming, I think AR-powered data visualizations are the next step.

In 2020, for instance, Mastercard announced a new augmented reality experience. As far as I can tell, the AR experience is no longer available on the app store. However, if it were, here is how it would work:

- Users open the mobile app.

- They scan their Mastercard credit card.

- They scan the 360-degree physical space around them.

- Three portals appear around the space—for Experiences, Everyday Value and Peace of Mind.

- Users tap the portals on their phone screens to access info about their benefits.

It’s an interesting concept—to visually present benefits information in an augmented reality environment. However, I suspect the reason this AR experience didn’t catch on is because it was too limited.

To get users to adopt an AR feature en masse, you’d need to apply it to something they use every day. Or to a feature that’s integral to the app.

This credit card AR concept on the AI in Tech YouTube channel is a more realistic use case:

The basic idea is that the customer could use their smartphone camera or a VR viewer to “look” at their credit card. They’d see all their account data without having to log into their banking app. For example, they’d find info related to account balances, recent transactions, rewards points, payment due dates and so much more.

Once financial services customers become accustomed to this hyper-convenient and low-effort way of accessing their account data, the technology can expand. It will be able to do what Mastercard proposed to do four years ago. Or it could be like what we see in this metaverse fintech case study:

Users won’t need to scan their credit or debit cards. They’ll just put on their VR viewer to check on their entire financial picture. They’ll see account balances, pending payments, spending trends, upcoming bills and more.

In addition to viewing this data in a 3D format, they’ll also be able to take action on it without having to open an app. Bill due? Tap the area that says “Pay Now.” It’ll be that simple.

AR for Geolocation Data

Have you ever been out and about somewhere and wondered where your nearest banking location or ATM was? This is another one of those AR use cases that’ll remove the need for you to log into your banking app or to do a search on Google Maps.

With the AR app installed, all you’d need to do is open your smartphone camera, hold it up wherever you are and look at your screen.

The National Bank of Oman (NBO) created an app for this exact purpose. You can see the concept of it in this YouTube video:

With this app enabled, users use their camera to find the nearest ATMs or branches as well as directions on how to get to them. In addition, users can find NBO rewards and other deals at local establishments this way.

It looks as though the landing page for this AR app was launched in 2020. While the page is still up, the links to the Google Play and Apple app stores don’t seem to be working. So I suspect this is another case of an AR/VR concept that was pulled off the market due to lack of demand.

That doesn’t mean there won’t be demand in the future though. With people spending so much of their time on smartphones and relying on them as a trusted resource when they’re out and about, AR applications like these would really come in handy.

However, like in the case of the credit card data visualization, it would take a financial institution with a massive user base (and, ideally, one that’s younger) to successfully bring this sort of thing to market. Once that happens, the floodgates will open.

Unlike the credit card use case, though, this one will most likely get off the ground if the app is developed around rewards. As fewer people go to banks or pay with cash, there won’t be as much need to find physical locations. But finding local establishments where they could get discounts or accrue points definitely would.

VR Customer Service Environments

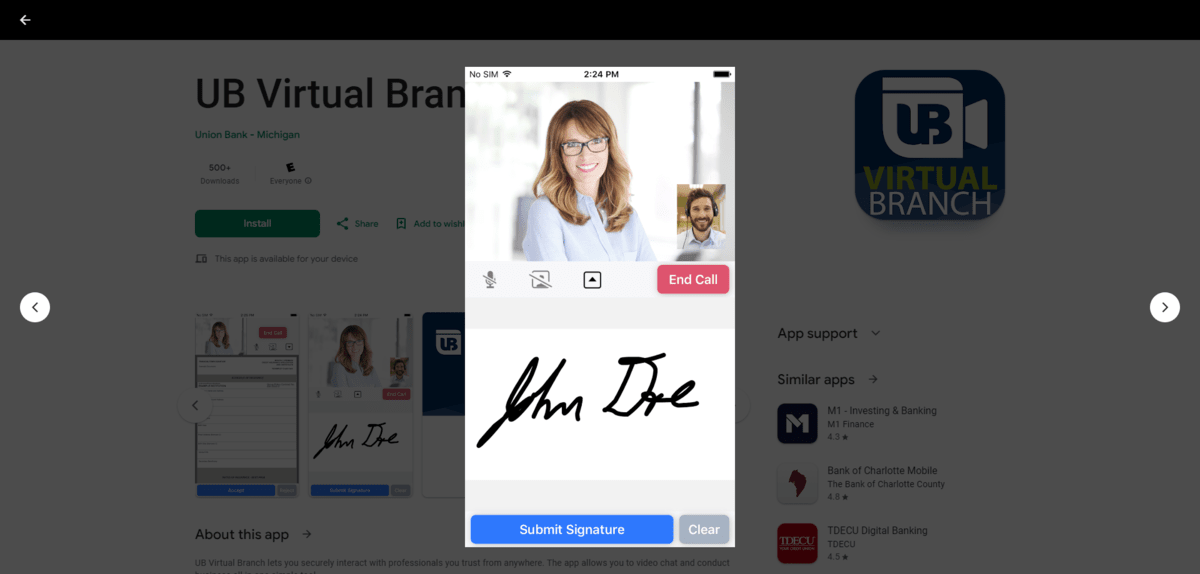

One of the examples I kept seeing as I researched this article was the virtual bank branch. I even found a bank that has a virtual branch app: Union Bank.

It’s not really what I had imagined when I envisioned a virtual “reality” branch though. It’s more like Zoom combined with DocuSign.

Here’s a screenshot from the Google Play app that shows you what the virtual branch looks like:

The top-half of the screen is basically Zoom. The bottom-half is for whatever transaction you’re working on. With this tool, customers can do things like open an account, order checks, manage their services and more. So this portion of the screen could show application forms, contracts, signature fields and so on.

I think what we see here in this UB virtual branch example is just the beginning.

What’s great about banks and other financial institutions offering virtual branches is that it makes financial services more accessible. In the case of banks and credit unions, not everyone is able to leave their homes to go speak to a representative. And in the case of fintech companies offering customer onboarding or support, there isn’t usually a way for users to connect with a real person outside of phone, email or text.

So a virtual bank would not only narrow that accessibility gap, it would allow fintech companies to offer more personal-feeling support to their users.

I also see this tech evolving. Right now, we see live representatives talking to customers. However, we could see a version of this similar to the Metaverse with fully virtualized worlds and avatars in place of our real world and faces.

I don’t think it would work for something like banking where people’s identities need to be verified before they can open an account or do a transfer. However, I think a fully virtualized “bank” or other financial center could be used in self-service transactions as well as personal account management.

For instance, let’s say someone wants to better understand the difference between a 401(k) vs. an IRA. They could read about it in the institution’s help center or blog, or they could go into the virtual “branch” and have a discussion with an advisor about it. The advisor could be an AI chatbot or it could be an avatar powered by a human representative.

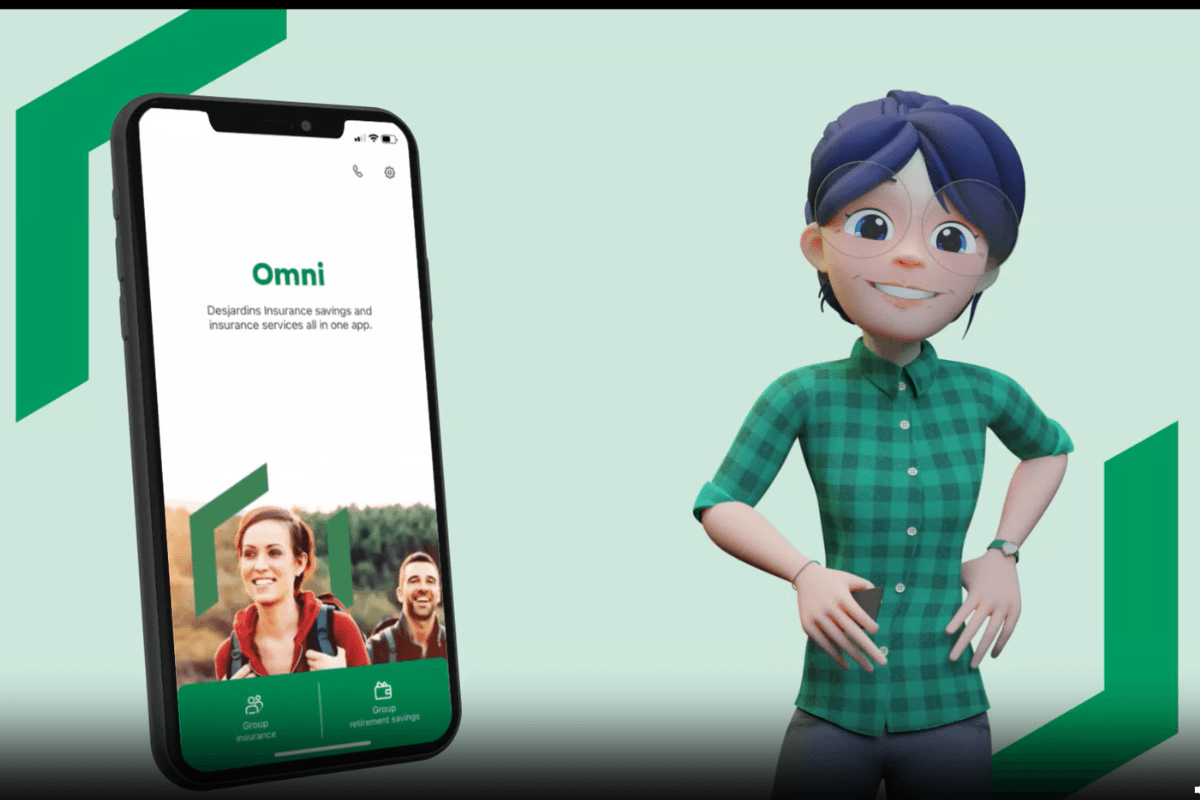

In 2014, Montreal-based Desjardins Insurance created a financial education program for its customers. The educational videos were designed to engage customers as they improved their financial literacy.

One strategy they used to boost engagement was to add a 6-year-old Penny avatar to the videos. Penny became a sort of virtual advisor, too.

When users downloaded the mobile app, they were asked to print out a “Penny Dollar.” When they held their smartphone over the printout, the AR Penny appeared in front of them.

They’d then have a conversation with Penny. She’d ask what they wanted to learn. In response, the user would tap different coins on their screen that represented different financial topics. A video would launch, featuring Penny’s response.

With how quickly ChatGPT has gained in popularity in just the last couple of years, I suspect this is the route that many fintech companies will go next. People have become conditioned to turn to AI for quick, succinct and easy to understand answers. An AR-powered 3D chat assistant that doesn’t require a significant amount of typing is the next natural step.

By the way, it looks as though Penny is still the company’s mascot.

She’s a bit older now, but she’s still guiding users through their retirement savings app. It doesn’t seem like the AR version of her is still around, though it might resurface whenever other companies begin to adopt this tech.

AR and VR Education

Financial literacy isn’t a subject that schools typically require the way they do English, math or science. However, all of us would benefit from it once we enter adulthood and start doing things like getting credit cards, paying bills, collecting paychecks, investing, saving for retirement and so on.

Because of this lack of foundation, financial services companies have had to step up and help educate their customers. The problem is, some of these financial topics and strategies can be complex. And many of them are often dry and boring.

There are ways to make this content more engaging. That’s what Desjardins Insurance was attempting to do by developing the Penny AR. However, financial companies won’t need to go that far with this technology.

Think about the difference between presenting information in a table format vs. as colorful and interactive data visualizations. That alone would capture users’ attention more effectively and make the information easier to digest.

With AR and VR, you’d be able to take those engaging graphics, make them 3D and present them in ways that make more sense than perhaps the data alone might.

In 2014, Fidelity developed a VR platform called StockCity for Oculus Rift and web browsers. Here’s a video that explains how the metaphorical buildings were designed to represent a stock portfolio:

The graphics look a bit dated today, but you still get a sense for how Fidelity was trying to simplify the concept of the stock market for investors. For instance, there are no visible numbers or percentages. Instead, buildings represent a stock and the height of them represents the price. Fidelity used other factors like a light and dark sky to convey when the stock market was open as well as weather to signal if the market was up or down.

As the video explains, this VR prototype was just an experiment. It was a very expensive experiment, too. At the time, Fidelity Labs was spending about $2.5 billion every year on developing technologies, even on ones such as this that they weren’t sure about.

“It’s unclear whether Fidelity’s new interface—which renders American commerce as a vast, impersonal business district populated by skyscrapers—will catch on. And they admit they have no clue. Fidelity is releasing this early version of StockCity in part so they can get feedback from consumers.”

We know now that it didn’t catch on. However, in a time where video is the king of marketing and short-form visual content on platforms like TikTok are heavily consumed, now would be the perfect time to dive back into AR and VR as educational vehicles for users.

In addition to providing fintech users with 3D models to better understand their finances, these technologies can be used to make finance management more interactive and fun.

For example, an AR or VR tool could help people set and maintain a budget. Take the StockCity concept of using geometry to convey data. Rather than enter numbers into category fields, users could take blocks that represent spending categories and stretch or compress them to the budget size they want. They can then stack those blocks until they reach their desired budget.

If this kind of technology isn’t currently in the works, it will be soon as financial services companies seek to better engage their users and retain their business over the long term.

Wrapping Up

As you can see, there’s not much in the way of AR or VR right now in the FinServ or fintech space. However, the companies who played around with these technologies five to 10 years ago were onto something.

Augmented and virtual realities could be hugely beneficial. This tech can simplify complex data and processes. It can improve financial literacy. It can also make it easier for users to perform actions, from opening an account to finding an ATM.

Although AR and VR are still considered emerging technologies in the financial space, the seeds have already been planted. Companies like Fidelity and Mastercard have already developed prototypes that demonstrate the capabilities of this tech. They were just about a decade too early with it.

But now that the audience is primed and ready for this kind of tech, it’s only a matter of time before it becomes a mainstream component of digital experience development.

Suzanne Scacca

A former project manager and web design agency manager, Suzanne Scacca now writes about the changing landscape of design, development and software.