3 Ways to Level Up Your Fintech Customer Service with a Chatbot

Summarize with AI:

Rather than point your fintech mobile app users to a phone number, email address or contact form, why not give them a conversational assistant that can effectively handle their requests while also improving their in-app experience?

Fintech has caused quite a stir in the financial services industry for years. But as major financial companies start to catch up by digitizing their offerings and moving to mobile, what can fintech businesses do to stay ahead of the curve?

I’d suggest a revamp of their customer service strategy. And here’s why:

I spent a few hours over the weekend installing and testing out mobile apps from banks, financial services companies and fintech providers. While doing so, I noticed that only a small percentage of them have a chatbot solution in place.

The rest of the apps relied on:

- A list of phone numbers or emails

- Self-service FAQs (some of which directed users to the website in their browser)

- Helpdesk forms with little to no information on when they’ll get a response back

There’s nothing wrong with providing these options as a backup. However, when they’re the only customer service option available for a high-tech financial solution, your users are going to have a really hard time getting the most from the app, let alone finding a good reason to stay committed to it.

What’s more, when you use outdated customer service channels to support your users, you’re only going to create more work for your support team in the end.

So, let’s spend some time today looking at why AI-powered chatbots create a huge competitive edge in the fintech space and what you can do to make the most of it.

Chatbot Customer Service in Fintech

Before the digitization of banking and other financial services, consumers relied on human-to-human customer service. But without a physical location and tellers or agents to handle these conversations, what’s your app to do?

That’s the beauty of financial mobile apps. Mobile users are already comfortable with texting as a means of communication. It’s fast, simple and convenient.

And what is a chatbot? It’s basically just another chat window. Only, instead of it being someone they know on the other end of the conversation, it’s an AI-powered bot.

Here are some ways to put yours to use:

Program Your Bot to Route Queries

When you think about it, the old way of getting in touch with financial services companies was quite inefficient for the business and its customers.

It might’ve involved tracking down the right number to call, waiting on hold for minutes at a time, and getting redirected through a number of departments if you didn’t reach the right rep the first time around. A similar chain of events would happen with in-person visits: having to find a nearby location, waiting in the queue, and eventually talking to someone only to find out you have to wait to meet with someone else.

With a chatbot built into your mobile app, however, you can cut out all this need to navigate and wait. Not only will this create a better customer service experience for your users, but it’ll free your team up to focus on the interactions that really require the human touch.

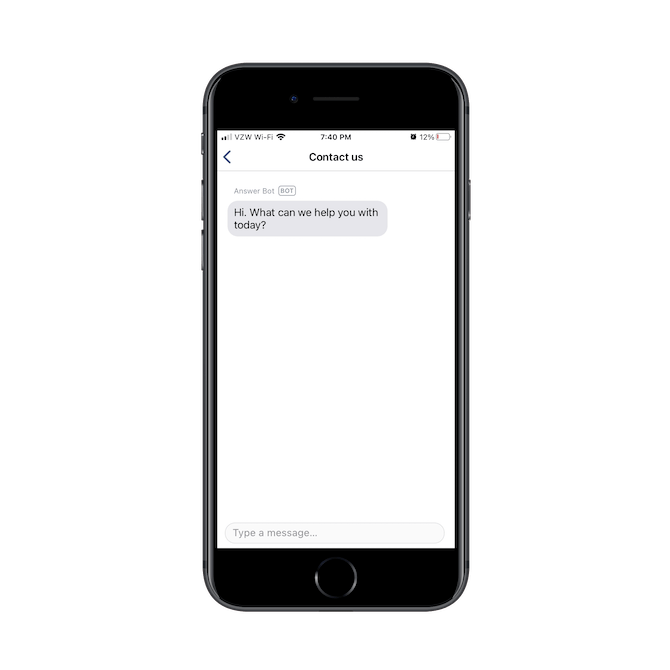

One app that uses its chatbot like a gatekeeper is Venmo. Users encounter it when they go to the “Contact us” area of the app:

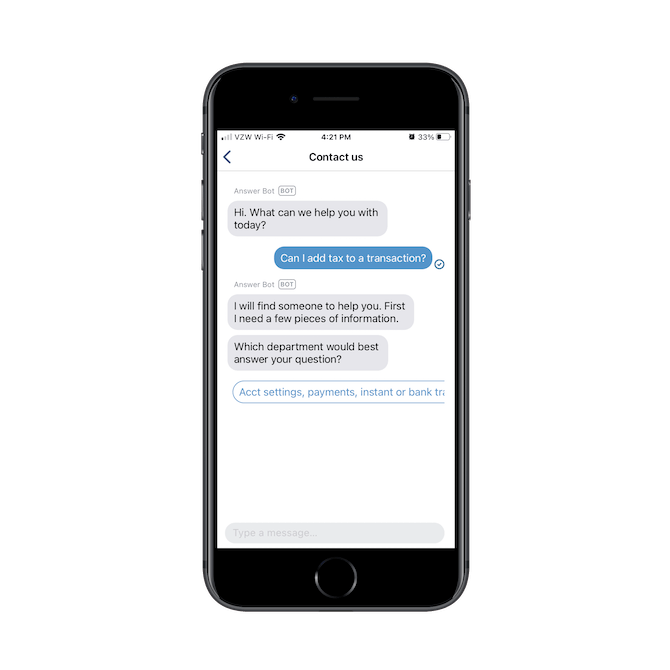

The greeting is simple and open-ended. However, thanks to natural language processing, the bot takes what the user asks and uses this information to point them toward the right department:

The bot recommends different departments that might help resolve the question or issue. Users then scroll through the options to find the right one.

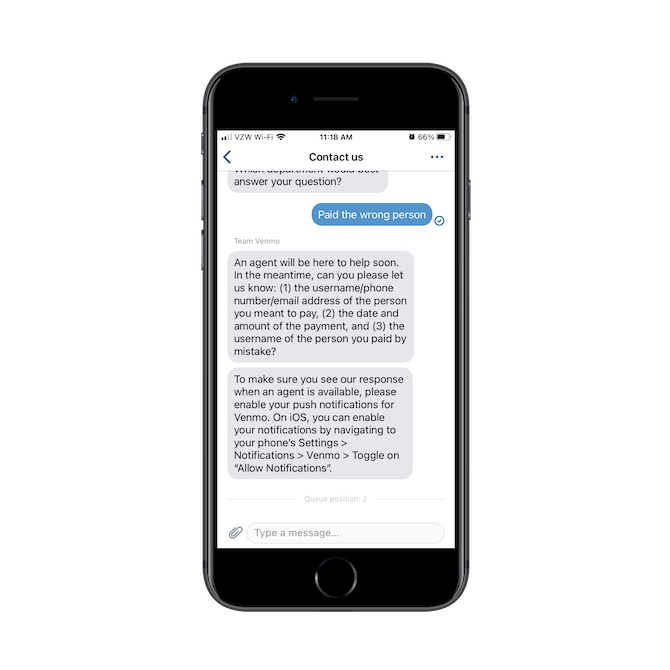

Once they select an option, the bot places them in the appropriate queue to chat with a live representative. Not only that, the bot handles the intake questionnaire, further making it easier for the customer service agent to delve right into the problem or question:

It’s kind of a rudimentary solution as the chatbot itself doesn’t seem to be able to provide any answers. However, for a company the size of Venmo, I think that’s okay. It’s automating that initial burden of fielding requests and gathering details that would otherwise consume the agents’ time.

As for how you use a chatbot to do this, consider what your users will need the most help with. You might find that programming your bot to answer common “How do I do this in the app?” questions is really useful. But in terms of routing their queries to live chat agents, how about the following:

- Tech support to help them when they run into kinks in the software

- Business support in case they have questions about things like a charge they received from the app, a security issue they noticed, etc.

- Financial support from actual certified pros and agents who can help them get the most out of the app

With a 24/7 chatbot-powered routing system, fintech companies should be able to keep more of their users satisfied with the mobile app.

Use the Chatbot to Provide Proactive and Personal Assistance

Once your users start using the mobile app, you’re going to get a ton of data on them. Why not use this data to improve the app experience even further?

Now, while I’m recommending “proactive” assistance here, I’m not really suggesting that your chatbot interrupt users while they’re using the app (unless it can detect them struggling with something). Instead the proactive approach comes once the user engages with the app.

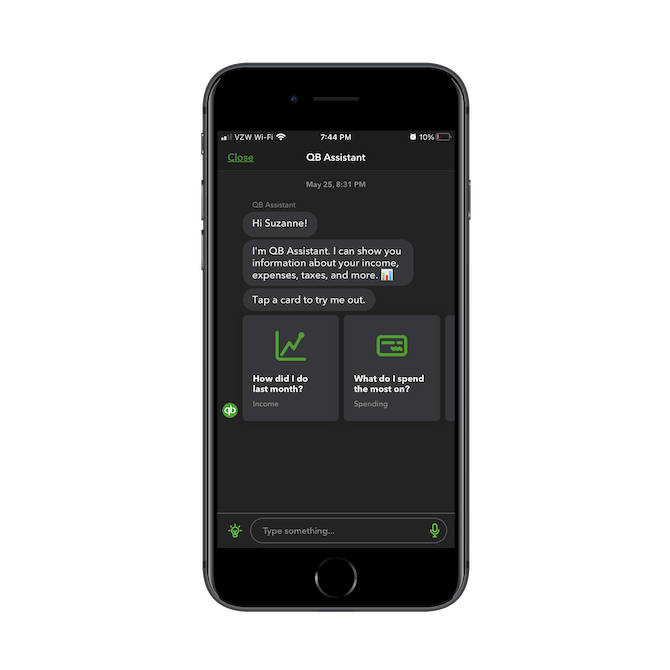

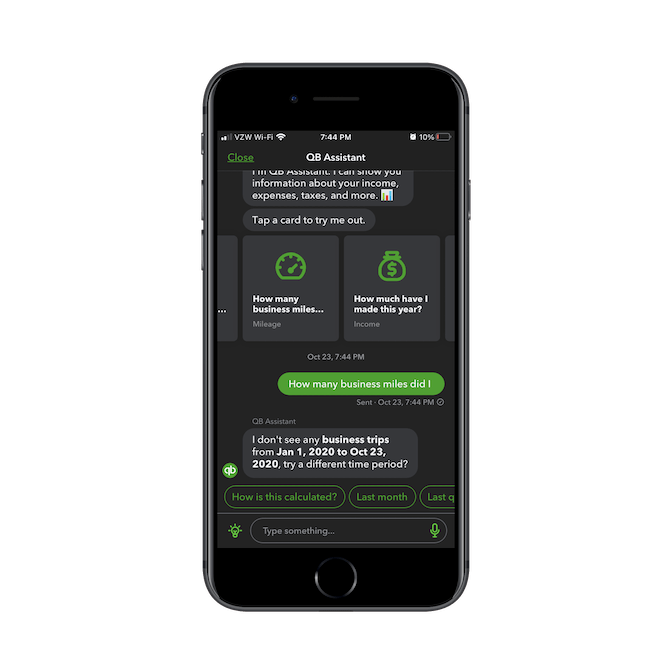

Let’s take a look at the QuickBooks QB Assistant:

This is what a user sees the first time they engage with the QB Assistant. It sends a personal and informal greeting. It introduces itself and explains what it can do (with a fun emoji). And then it serves up pre-made options:

While this data is all located inside the app, QB Assistant actually makes it easier to calculate. For instance, a question like “What do I spend the most on?” can definitely be calculated under Expenses, but it takes some configuration to narrow down what the user is looking at and then to sort it. QB Assistant does this instantaneously.

For business owners using this software to remove the burden of managing their own finances, this is a huge win. Plus, considering how painful money management can be for many people, having a chatbot that can calculate useful metrics on the spot ensures that your users get and use all the data available, even if they don’t want to (or don’t know how to) track it down.

Empower the Chatbot to Execute Quick Tasks

Data analysis is a really important feature in finance apps. I’d say that if you had to prioritize how you put your chatbot to work for you, that should be the top priority.

After that, it wouldn’t be a bad idea to teach your chatbot how to execute quick tasks. Even if your app’s design enables users to take quick actions (which I explained in point #3 in this post), why not give your bot the power to streamline it even further?

Think of it like creating a Siri or Alexa for your app. Millions of people are comfortable enough using virtual assistants to execute tasks on their devices, so chances are good your users would appreciate similar functionality (voice or text) with your bot.

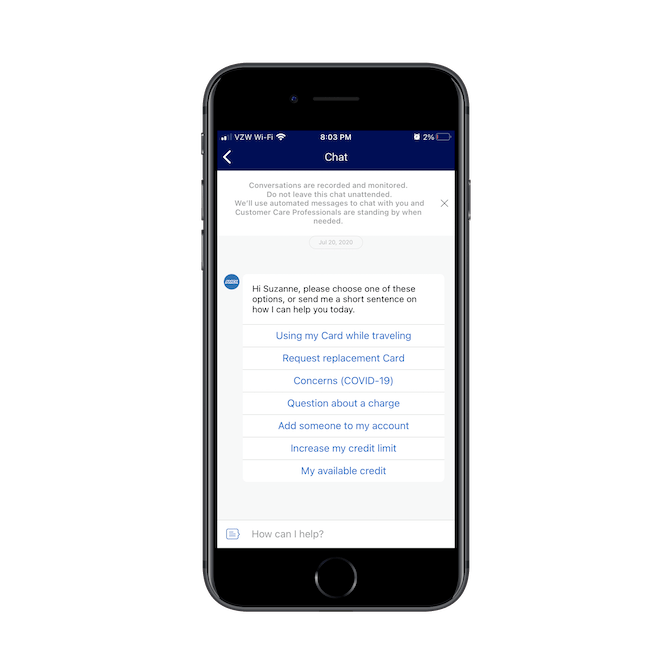

Some of the big banking and credit card companies already have this functionality in their mobile apps. American Express, for instance, uses its chatbot to do all of the things we’ve already looked at today:

- Route to other departments

- Answer common questions

- Provide tips and guidance based on personal data

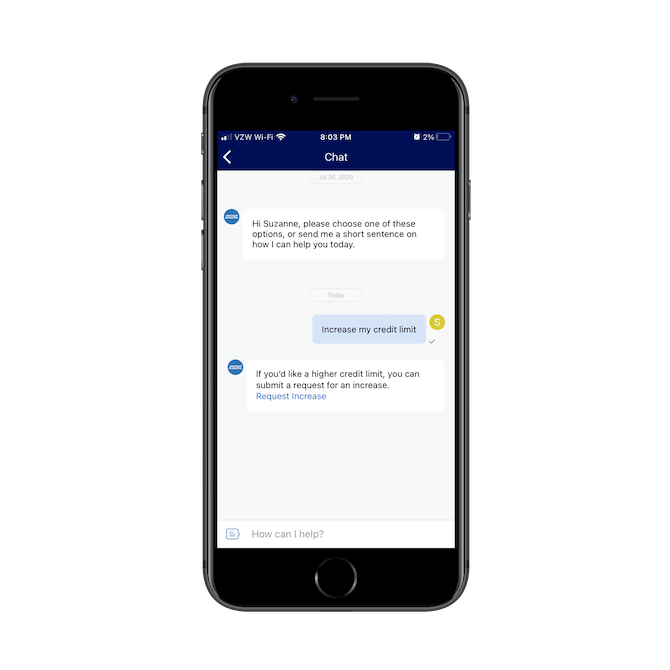

It also helps users execute tasks:

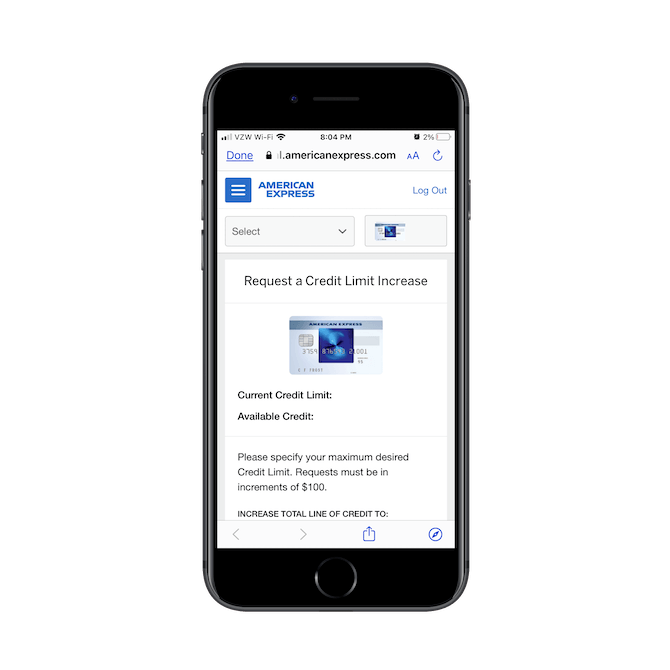

Say, for instance, an AmEx customer wants to increase their credit limit. They can type out the question on their own or select the “Increase my credit limit” option if it’s provided. This is what AmEx does next:

It confirms the request and then provides a link that takes them to a new page. It’s here that the customer will find their credit limit pre-populated. All they have to do is enter a new limit and then submit the request. Everything is completely streamlined:

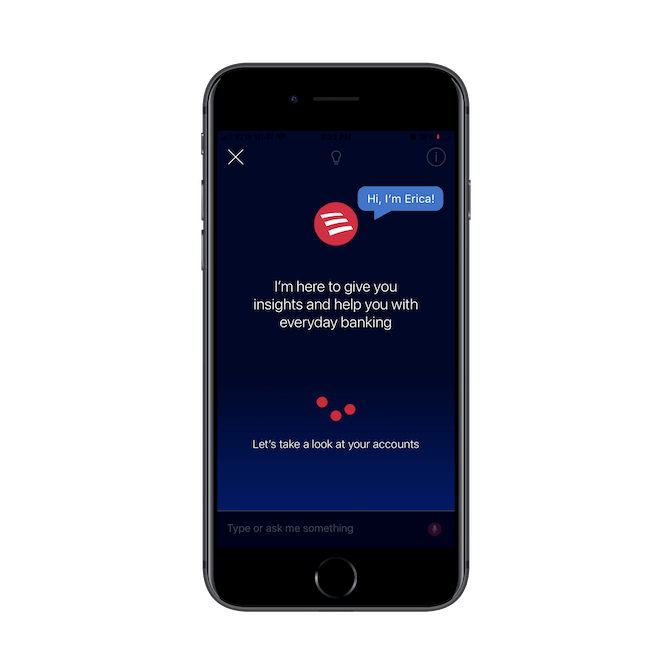

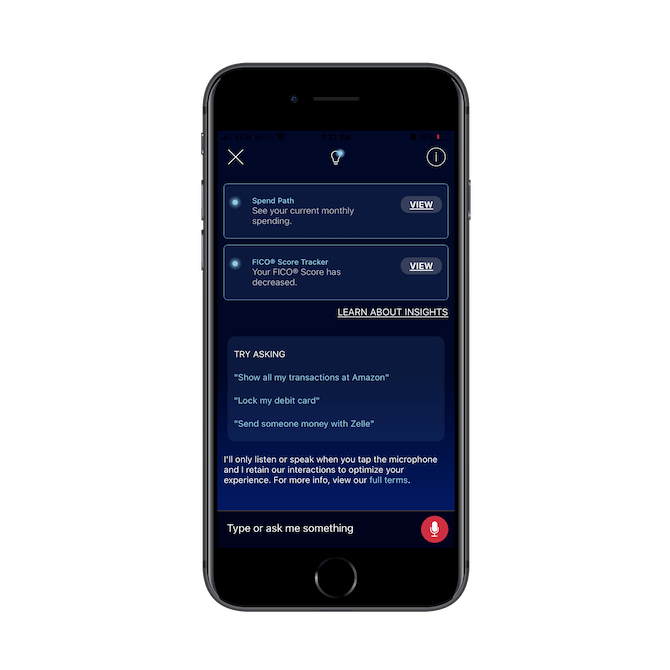

Bank of America is another one that does this. Its mobile app has a virtual assistant called Erica. Users have the option to type out their query or use the voice option to interact with the bot:

When users first interact with Erica, the bot pulls up a summary of their accounts, followed by useful suggestions based on their app usage and habits:

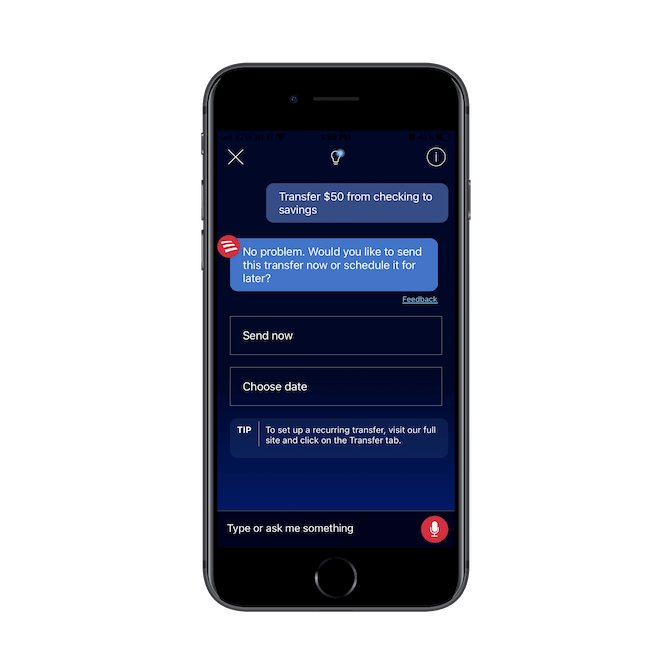

Users can choose one of the recommended queries or they can add their own. Here’s what would happen if someone asked Erica to transfer money between their checking and savings accounts:

Again, while users could do this on their own, it might be faster or easier for them to just shoot Erica a line and ask the bot to do it for them.

If you can think of shortcuts like these that your users would benefit from, build them into your app. Your users will see it as a much more valuable tool in the end.

Wrap-Up

There are a number of reasons why fintech apps (and, really, all financial services companies) should have a chatbot:

- It’ll do the brunt of the work, which means you won’t need as large of a customer service team on staff to handle mundane requests

- When you and your customer service team spend less time resolving common requests, you can put your energies towards more meaningful and profitable activities

- Having a 24/7 customer service “agent” will reduce the amount of user churn caused by a lack of support when they need it

If you’re already in the mindset that consumers would benefit from digitized financial services, why not take it one step further and digitize customer service to level up their experience even more?

The better service you can provide—to support the service you’re providing, the technical product and the overall relationship you have with them—the more satisfied your users will be. And a greatly satisfied mobile app user is one that’s willing to use and keep that app for a long time.

Suzanne Scacca

A former project manager and web design agency manager, Suzanne Scacca now writes about the changing landscape of design, development and software.